Digital Federal Credit Union: A Comprehensive Overview

The digital federal credit union, often referred to as a DCU, has emerged as a revolutionary financial institution that blends the traditional banking model with cutting-edge technology. In this article, we delve into the various aspects of a digital federal credit union, providing you with a detailed and multi-dimensional introduction.

Understanding the Concept

A digital federal credit union is a financial cooperative that provides its members with a range of financial services, including savings accounts, loans, and credit cards. Unlike traditional banks, DCUs are not-for-profit organizations, which means they reinvest their earnings back into the community and their members.

Membership and Eligibility

Joining a digital federal credit union is relatively straightforward. You typically need to meet certain eligibility criteria, such as being a member of a specific organization or living in a particular geographic area. Once you become a member, you gain access to a wide array of financial products and services.

Financial Products and Services

One of the key advantages of a digital federal credit union is the variety of financial products and services it offers. Here’s a breakdown of some of the most popular offerings:

| Product/Service | Description |

|---|---|

| Savings Accounts | Members can deposit funds into savings accounts, earning interest on their balances. |

| Checking Accounts | Checking accounts provide members with a convenient way to manage their day-to-day finances. |

| Loans | DCUs offer various types of loans, including personal loans, auto loans, and mortgages. |

| Credit Cards | Credit cards with competitive interest rates and rewards programs are available to members. |

| Online Banking | Members can access their accounts, make transactions, and manage their finances online. |

Technology and Innovation

Technology plays a crucial role in the operations of a digital federal credit union. These institutions leverage advanced tools and platforms to enhance the customer experience and streamline their services. Here are some of the key technological aspects:

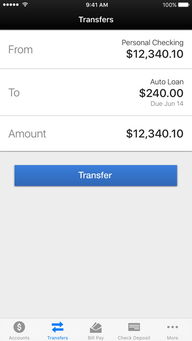

- Mobile Banking: Members can access their accounts and perform transactions through their smartphones or tablets.

- Online Banking: A user-friendly online platform allows members to manage their finances from the comfort of their homes.

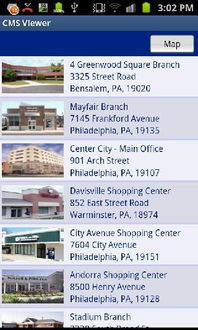

- ATM Access: Members have access to a network of ATMs where they can withdraw cash, deposit funds, and perform other transactions.

- Security: DCUs employ robust security measures to protect their members’ personal and financial information.

Community Impact

As not-for-profit organizations, digital federal credit unions prioritize the well-being of their members and the community. They often engage in various initiatives aimed at improving financial literacy, supporting local businesses, and providing affordable financial services to underserved populations.

Conclusion

In conclusion, a digital federal credit union is a modern financial institution that combines the traditional banking model with innovative technology. By offering a wide range of financial products and services, these institutions provide members with convenient and affordable access to financial resources. As technology continues to evolve, digital federal credit unions are well-positioned to meet the changing needs of their members and contribute positively to their communities.