Understanding Uniswap (uni.swap): A Comprehensive Guide

Uniswap, often referred to as uni.swap, has emerged as a pivotal player in the decentralized finance (DeFi) space. As a decentralized exchange (DEX) based on the Ethereum blockchain, Uniswap has revolutionized the way users trade cryptocurrencies. In this detailed guide, we’ll delve into the various aspects of Uniswap, including its unique features, the UNI token, and its impact on the DeFi ecosystem.

What is Uniswap (uni.swap)?

Uniswap is a protocol that facilitates decentralized token exchange on the Ethereum blockchain. It operates through smart contracts, eliminating the need for a centralized authority. This means users can trade tokens directly with each other, without relying on a third-party platform. The platform is designed to be transparent, secure, and accessible to anyone with an Ethereum wallet.

How Does Uniswap (uni.swap) Work?

Uniswap operates on a unique automated market maker (AMM) model. Instead of relying on order books like traditional exchanges, Uniswap uses liquidity pools, which are collections of tokens locked in smart contracts. These pools enable users to trade tokens directly with each other, with the price determined by the supply and demand of the tokens in the pool.

| Token | Price | Supply | Pool Size |

|---|---|---|---|

| ETH | $2000 | 1000 ETH | $2,000,000 |

| UNI | $10 | 100,000 UNI | $1,000,000 |

When you trade tokens on Uniswap, you are essentially interacting with these liquidity pools. If you want to buy UNI, you’ll need to provide ETH to the pool, and vice versa. The price of UNI will be determined by the ratio of ETH to UNI in the pool.

The UNI Token

The UNI token is the native governance token of Uniswap. It was launched through an airdrop to early contributors and liquidity providers. Holders of UNI tokens have the power to vote on key decisions affecting the Uniswap protocol, including fee changes, new feature implementations, and governance proposals.

Here are some key features of the UNI token:

-

Participation in governance: UNI token holders can vote on critical decisions that shape the future of Uniswap.

-

Access to community pool: UNI holders can allocate funds from the community pool to support projects and initiatives that benefit the Uniswap ecosystem.

-

Protocol fees: A portion of the trading fees generated by Uniswap is distributed to UNI holders as rewards.

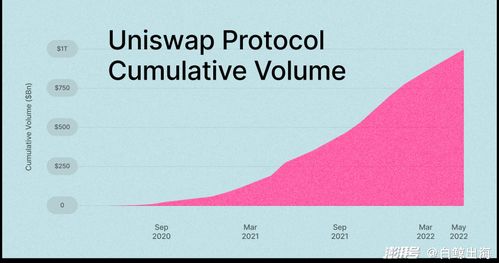

Uniswap’s Impact on the DeFi Ecosystem

Uniswap has played a significant role in the growth of the DeFi ecosystem. By providing a decentralized and transparent platform for token trading, Uniswap has enabled users to access a wide range of financial services without the need for intermediaries. This has led to increased liquidity, lower transaction costs, and greater accessibility for users worldwide.

Here are some key impacts of Uniswap on the DeFi ecosystem:

-

Increased liquidity: Uniswap’s liquidity pools have attracted a large number of tokens, making it easier for users to trade a wide range of cryptocurrencies.

-

Lower transaction costs: By eliminating the need for intermediaries, Uniswap has significantly reduced transaction costs for users.

-

Greater accessibility: Uniswap’s decentralized nature has made it accessible to users worldwide, regardless of their location or financial background.

Conclusion

Uniswap (uni.swap) has become a cornerstone of the DeFi ecosystem, providing a decentralized and transparent platform for token trading. With its innovative AMM model, the UNI token, and its impact on the DeFi ecosystem, Uniswap has set a new standard for decentralized exchanges. As the DeFi space continues to grow, Uniswap is well-positioned to play a crucial role in shaping its future