Understanding Uni Dex Price: A Comprehensive Guide

When it comes to the world of cryptocurrency, the price of UniDex is a topic that often sparks curiosity and debate. UniDex, a decentralized exchange (DEX) built on the Ethereum network, has gained significant attention due to its unique features and growing user base. In this article, we will delve into the various aspects of UniDex price, providing you with a detailed and multi-dimensional understanding.

What is UniDex?

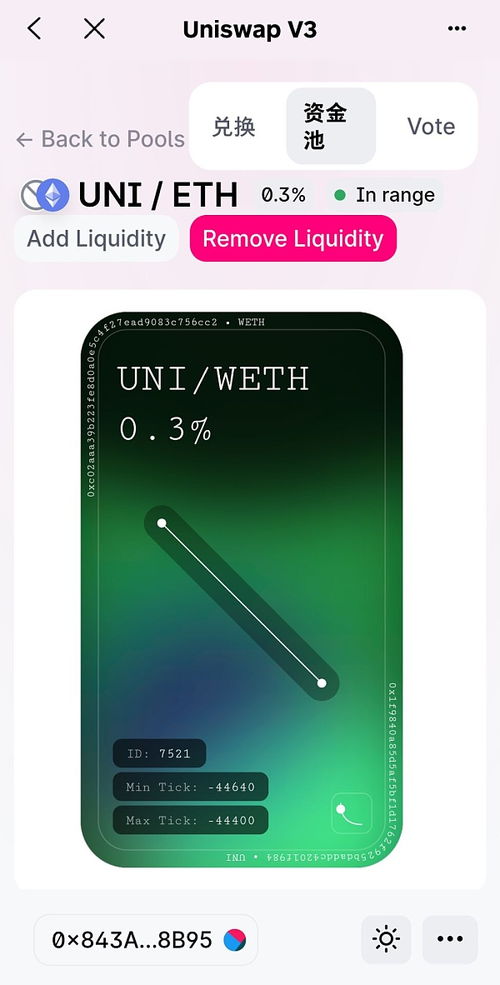

UniDex is a decentralized exchange that allows users to trade various cryptocurrencies directly from their wallets. Unlike traditional centralized exchanges, UniDex operates on the Ethereum blockchain, ensuring transparency, security, and decentralization. The platform offers a wide range of trading pairs, making it a popular choice for both beginners and experienced traders.

Factors Influencing UniDex Price

Several factors can influence the price of UniDex. Let’s explore some of the key factors that play a role in determining its value:

| Factor | Description |

|---|---|

| Market Supply and Demand | The basic principle of supply and demand applies to UniDex as well. An increase in demand for UniDex tokens can lead to a rise in its price, while a decrease in demand can cause the price to fall. |

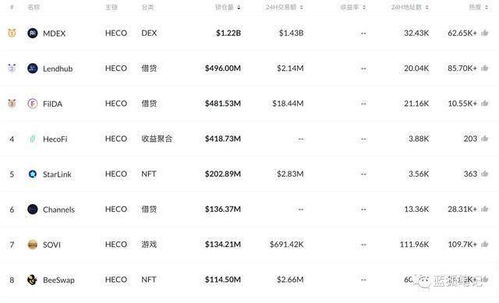

| Trading Volume | The trading volume on UniDex can have a significant impact on its price. Higher trading volumes often indicate higher liquidity, which can attract more users and potentially increase the price. |

| Market Sentiment | Market sentiment plays a crucial role in determining the price of UniDex. Positive news, partnerships, or successful projects can boost the price, while negative news or setbacks can lead to a decline. |

| Competition | The presence of other decentralized exchanges in the market can affect the price of UniDex. If competitors offer better features or lower fees, it may lead to a decrease in UniDex’s price. |

How to Track UniDex Price

Tracking the price of UniDex is essential for both traders and investors. Here are some popular methods to keep an eye on the price:

-

Crypto Exchanges: Many popular crypto exchanges, such as Binance, Coinbase, and Kraken, provide real-time price updates for UniDex.

-

Crypto Market Data Platforms: Platforms like CoinMarketCap and CoinGecko offer comprehensive information about UniDex, including its price, market cap, and trading volume.

-

News and Social Media: Staying updated with the latest news and developments in the cryptocurrency industry can help you gauge the market sentiment and make informed decisions.

UniDex Price Prediction

Predicting the future price of UniDex is a challenging task, as it involves numerous variables and uncertainties. However, some experts and analysts use various techniques to make predictions. Here are a few methods commonly used:

-

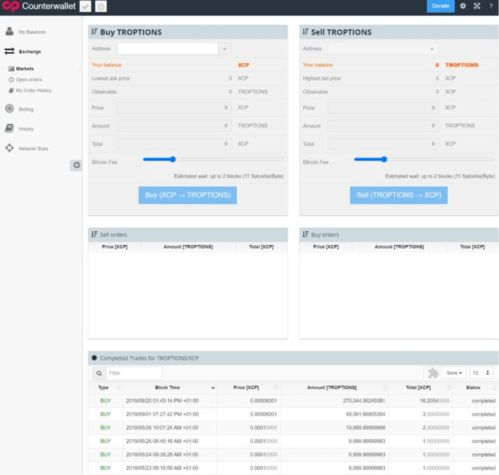

Technical Analysis: Traders use technical analysis tools, such as charts and indicators, to analyze past price movements and predict future trends.

-

Fundamental Analysis: Experts analyze the underlying factors, such as market demand, supply, and project developments, to predict the future price of UniDex.

-

Sentiment Analysis: By analyzing market sentiment and news, analysts can gauge the potential impact on the price of UniDex.

UniDex Price History

Understanding the historical price movements of UniDex can provide valuable insights into its potential future performance. Here’s a brief overview of UniDex’s price history:

| Time Period | Price Range |

|---|---|

| 2020 | $0.01 – $0.05 |

| 2021 | $0.05 – $0.20 |