Understanding the Financial Aid Office at University Name

When it comes to navigating the financial landscape of higher education, the financial aid office at University Name stands as a beacon of support for students and their families. This comprehensive guide will delve into the various aspects of the financial aid office, providing you with a detailed understanding of its services, processes, and resources.

Services Offered

The financial aid office at University Name offers a wide range of services to ensure that students have access to the financial resources they need to pursue their academic goals. Here are some of the key services provided:

-

Financial Aid Counseling: The office provides individualized counseling sessions to help students understand their financial aid options, including grants, scholarships, loans, and work-study programs.

-

Financial Aid Application Assistance: Staff members are available to guide students through the financial aid application process, ensuring that all necessary forms are completed accurately and on time.

-

Financial Literacy Workshops: The office hosts workshops to educate students on budgeting, financial planning, and responsible borrowing.

-

Disbursement of Financial Aid: The office manages the disbursement of financial aid funds to students’ university accounts, ensuring that they have access to the funds when needed.

-

Loan Counseling: For students who take out loans, the office provides counseling sessions to help them understand the terms and conditions of their loans.

Application Process

Understanding the application process for financial aid is crucial for students and their families. Here’s a step-by-step guide to the process at University Name:

-

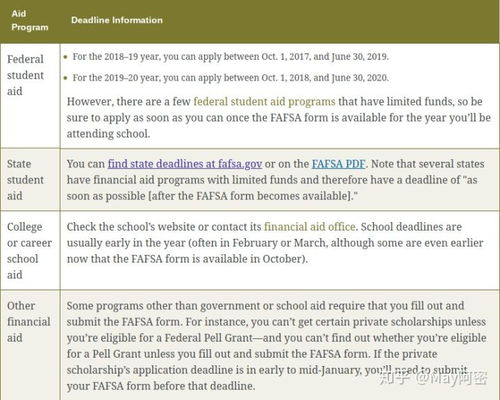

Complete the Free Application for Federal Student Aid (FAFSA): Students must submit the FAFSA to determine their eligibility for federal financial aid. The office provides assistance with the FAFSA application process.

-

Review Financial Aid Offers: Once the FAFSA is processed, students will receive a financial aid offer from the university. The office will help students understand their offer and any additional requirements.

-

Accept or Decline Financial Aid: Students must accept or decline their financial aid offers through the university’s online portal. The office is available to answer any questions or concerns during this process.

-

Complete Additional Requirements: Some students may be required to submit additional documentation, such as tax returns or verification forms. The office will guide students through this process.

-

Stay Informed: Students should regularly check their university email and financial aid portal for updates and important deadlines.

Types of Financial Aid

University Name offers a variety of financial aid options to help students meet their educational expenses. Here’s an overview of the types of financial aid available:

| Type of Financial Aid | Description |

|---|---|

| Grants | Financial aid that does not need to be repaid, typically based on financial need. |

| Scholarships | Financial aid awarded based on academic achievements, extracurricular activities, or other criteria. |

| Loans | Financial aid that must be repaid, often with interest. Federal loans have fixed interest rates, while private loans may have variable rates. |

| Work-Study | Financial aid that provides students with part-time employment opportunities on or off campus. |

Financial Literacy Resources

Financial literacy is an essential skill for students as they navigate the complexities of higher education and beyond. The financial aid office at University Name offers a variety of resources to help students develop their financial literacy skills:

-

Online Financial Literacy Resources: The office maintains a website with a wealth of information on budgeting, saving, and responsible borrowing.

-

Workshops and Seminars: The office hosts workshops and seminars on topics such as credit management, investing, and financial planning.

-

One-on-One Counseling: Students can schedule individual counseling sessions with financial aid staff to discuss their financial goals and concerns.

function pinIt()

{

var e = document.createElement('script');

e.setAttribute('type','text/javascript');

e.setAttribute('charset','UTF-8');

e.setAttribute('src','https://assets.pinterest.com/js/pinmarklet.js?r='+Math.random()*99999999);

document.body.appendChild(e);

}