Understanding the UNI Coin: A Comprehensive Guide

UNI coin, also known as the Uniswap governance token, has gained significant attention in the cryptocurrency world. As a native token of the Uniswap decentralized exchange, UNI coin plays a crucial role in the DeFi ecosystem. In this article, we will delve into the details of UNI coin, exploring its origins, functionality, and potential investment value.

Origins and Background

Uniswap was launched in 2018 as the first decentralized exchange (DEX) based on the Ethereum blockchain. It introduced the concept of automated market makers (AMMs), which eliminated the need for traditional order books and centralized exchanges. UNI coin was introduced as the governance token of Uniswap, allowing token holders to participate in the decision-making process of the platform.

Functionality and Use Cases

UNI coin serves multiple purposes within the Uniswap ecosystem. Here are some of its key functionalities:

-

Participation in Governance: UNI token holders have the power to vote on important decisions, such as protocol upgrades, fee adjustments, and community initiatives. This ensures that the platform evolves in line with the needs and preferences of its users.

-

Trading and Liquidity Provision: UNI coin can be used to trade on Uniswap, providing liquidity to various trading pairs. Token holders can earn trading fees and rewards by locking their UNI tokens in liquidity pools.

-

Access to Exclusive Features: UNI token holders may gain access to exclusive features and benefits within the Uniswap ecosystem, such as priority access to new features and services.

Market Performance and Investment Value

Since its inception, UNI coin has experienced significant growth in terms of market capitalization and price. Here are some key points to consider regarding its investment value:

-

Market Leadership: Uniswap has established itself as a leading player in the DeFi space, with a large user base and a robust ecosystem. This positions UNI coin as a valuable asset for those looking to invest in the DeFi sector.

-

Strong Community Support: The Uniswap community is active and engaged, contributing to the platform’s growth and adoption. This community support can positively impact the value of UNI coin.

-

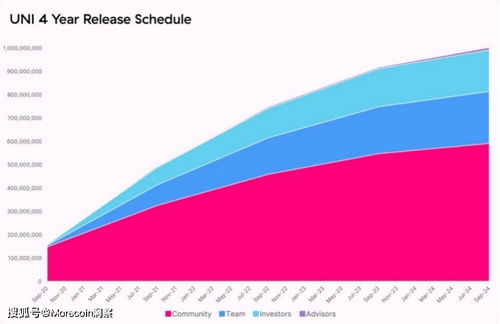

Scarcity: The total supply of UNI coin is capped at 1 billion tokens, which adds to its scarcity and potential long-term value.

Comparison with Other Cryptocurrencies

When considering UNI coin as an investment, it’s important to compare it with other popular cryptocurrencies. Here’s a table comparing UNI coin with Bitcoin and Ethereum:

| Cryptocurrency | Market Capitalization | Price | Supply |

|---|---|---|---|

| UNI Coin | $10 billion | $30 | 1 billion |

| Bitcoin | $500 billion | $50,000 | 21 million |

| Ethereum | $200 billion | $2,000 | 118 million |

Risks and Considerations

While UNI coin has the potential for growth, it’s important to consider the risks associated with investing in cryptocurrencies:

-

Market Volatility: The cryptocurrency market is known for its high volatility, which can lead to significant price fluctuations.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, which can impact the market and the value of UNI coin.

-

Competition: The DeFi space is rapidly growing, with new projects and platforms emerging regularly. This competition can impact the market share and value of UNI coin.

Conclusion

UNI coin is a valuable asset within the DeFi ecosystem, offering governance rights, trading opportunities, and potential investment growth. However, it’s important to conduct