aave amm uni wbtc usdc: A Comprehensive Guide

When it comes to decentralized finance (DeFi), the terms aave, amm, uni, wbtc, and usdc are often thrown around. But what do they actually mean? In this article, we’ll delve into each of these terms, providing you with a detailed and multi-dimensional understanding of their roles and significance in the DeFi ecosystem.

Understanding aave

aave is a decentralized lending and borrowing platform that allows users to earn interest on their deposits and borrow assets without the need for a centralized entity. It operates on the Ethereum blockchain and utilizes smart contracts to facilitate transactions.

One of the key features of aave is its Automated Market Maker (AMM) model. This model allows users to trade assets directly with each other, eliminating the need for a centralized exchange. Instead, the price of assets is determined by the supply and demand dynamics of the market.

Exploring amm

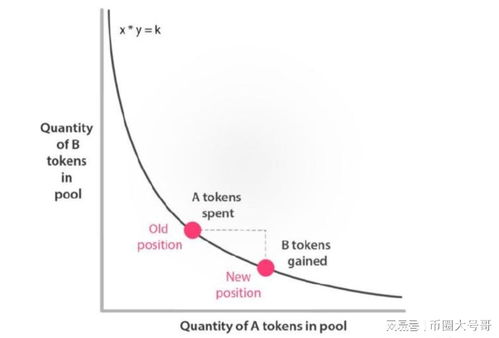

AMM stands for Automated Market Maker. It is a decentralized trading mechanism that allows users to trade assets directly with each other, without the need for a centralized exchange. AMMs are becoming increasingly popular in the DeFi space due to their ability to provide liquidity and enable seamless trading experiences.

AMMs work by using a mathematical formula to calculate the price of assets based on the supply and demand dynamics. This formula ensures that the price of assets remains relatively stable, even during periods of high volatility.

Understanding uni

Uni (formerly Uniswap) is a decentralized exchange (DEX) that operates on the Ethereum blockchain. It is one of the most popular DEXs in the DeFi space, known for its liquidity pools and AMM model.

Uni allows users to trade a wide range of assets, including cryptocurrencies, tokens, and stablecoins. It provides a seamless and efficient trading experience, with low transaction fees and high liquidity.

Delving into wbtc

WBTC, or Wrapped Bitcoin, is a token that represents Bitcoin (BTC) on the Ethereum blockchain. It allows users to trade, store, and earn interest on their Bitcoin holdings without leaving the Ethereum ecosystem.

By wrapping Bitcoin into a token, users can access a wide range of DeFi applications and services that are built on the Ethereum network. This provides a convenient and efficient way to leverage the value of Bitcoin in the DeFi space.

Understanding usdc

USDC is a stablecoin that is backed by the US dollar. It is one of the most popular stablecoins in the DeFi space, known for its stability and reliability.

USDC is often used as a medium of exchange in DeFi applications, as it provides a stable value that is not subject to the volatility of traditional cryptocurrencies. It is also widely accepted by various DeFi platforms and services.

Table: Comparison of aave, amm, uni, wbtc, and usdc

| Term | Description |

|---|---|

| aave | Decentralized lending and borrowing platform |

| amm | Automated Market Maker for decentralized trading |

| uni | Decentralized exchange with liquidity pools and AMM model |

| wbtc | Token representing Bitcoin on the Ethereum blockchain |

| usdc | Stablecoin backed by the US dollar |

By understanding the roles and significance of aave, amm, uni, wbtc, and usdc, you can gain a deeper insight into the DeFi ecosystem and its various applications. Whether you’re a beginner or an experienced user, these terms are essential to navigate the world of decentralized finance.