BDO UniBank: A Comprehensive Overview

BDO UniBank is a financial institution that has been serving the Philippine market for many years. As a part of the BDO Unibank, Inc. group, it offers a wide range of banking services to both individuals and businesses. In this article, we will delve into the various aspects of BDO UniBank, including its history, services, technology, and customer experience.

History and Background

BDO UniBank was established in 1968 as Banko ng Davao. It was initially a small commercial bank in Davao City, Philippines. Over the years, the bank expanded its operations and became one of the leading financial institutions in the country. In 2002, it merged with the Universal Bank, hence the name BDO UniBank. Today, it is a part of the BDO Unibank, Inc. group, which is one of the largest financial institutions in the Philippines.

Services Offered

BDO UniBank offers a comprehensive range of banking services to cater to the needs of its diverse clientele. Here are some of the key services it provides:

-

Personal Banking: BDO UniBank offers various personal banking services, including savings accounts, checking accounts, loans, and credit cards.

-

Business Banking: The bank provides a wide range of business banking services, such as current accounts, fixed deposits, loans, and trade finance.

-

Corporate Banking: BDO UniBank caters to the needs of large corporations and offers services like cash management, trade finance, and investment banking.

-

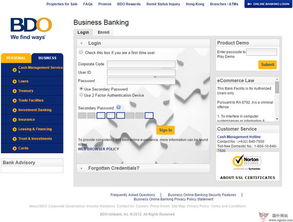

Online Banking: The bank offers an online banking platform called BDO Online, which allows customers to access their accounts, make transactions, and manage their finances conveniently.

-

Mobile Banking: BDO UniBank also provides a mobile banking app called BDO Mobile, which allows customers to perform transactions and manage their accounts on the go.

Technology and Innovation

BDO UniBank has been at the forefront of technology and innovation in the banking industry. The bank has invested heavily in technology to enhance its services and improve customer experience. Here are some of the key technological advancements made by BDO UniBank:

-

Online Banking: BDO Online is a user-friendly platform that allows customers to access their accounts, make transactions, and manage their finances from anywhere, anytime.

-

Mobile Banking: BDO Mobile is a convenient app that allows customers to perform transactions, check account balances, and receive notifications on their mobile devices.

-

ATMs: BDO UniBank has a vast network of ATMs across the Philippines, making it easy for customers to withdraw cash, deposit money, and check account balances.

-

Biometric Authentication: The bank has implemented biometric authentication for its ATMs, providing an additional layer of security for its customers.

Customer Experience

BDO UniBank is committed to providing exceptional customer service. The bank has a dedicated customer service team that is available to assist customers with their queries and concerns. Here are some of the key aspects of BDO UniBank’s customer experience:

-

Customer Service: BDO UniBank offers a wide range of customer service channels, including phone, email, and in-person visits to its branches.

-

Branch Network: The bank has a vast network of branches and service centers across the Philippines, making it easy for customers to access its services.

-

Customer Satisfaction: BDO UniBank has consistently received high ratings for customer satisfaction, thanks to its commitment to providing exceptional service.

Financial Performance

BDO UniBank has been performing well financially, with consistent growth in its revenue and profitability. Here is a brief overview of its financial performance:

| Year | Net Income (PHP million) | Net Interest Margin (%) |

|---|---|---|

| 2018 | 30,698 | 2.89 |

| 2019 | 34,598 |