Understanding Uni Credit Login: A Comprehensive Guide

Are you looking to explore the ins and outs of Uni Credit Login? Whether you’re a new user or someone who has been navigating the platform for a while, understanding how to effectively use Uni Credit Login can greatly enhance your experience. In this detailed guide, we will delve into various aspects of the login process, ensuring you have a thorough understanding of how to manage your account, access your financial information, and stay secure online.

What is Uni Credit Login?

Uni Credit Login is a secure platform that allows users to access their financial accounts, manage transactions, and perform a variety of other banking activities. It is designed to provide a seamless and convenient experience for users, ensuring that their financial information remains protected at all times.

How to Create a Uni Credit Login Account

Creating a Uni Credit Login account is a straightforward process. Here’s a step-by-step guide to help you get started:

- Visit the Uni Credit website and click on the “Sign Up” button.

- Enter your personal details, such as your name, date of birth, and contact information.

- Choose a username and password for your account. Make sure to create a strong password that includes a mix of letters, numbers, and special characters.

- Provide any additional information required, such as your employment details or income information.

- Submit your application and wait for approval from Uni Credit.

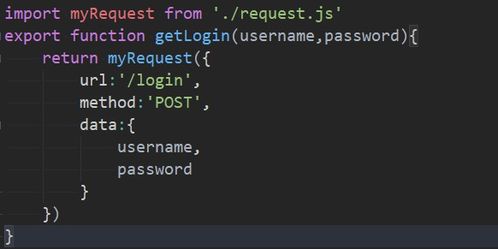

Logging into Your Uni Credit Account

Once you have created your account, logging in is a simple process:

- Visit the Uni Credit website and click on the “Login” button.

- Enter your username and password.

- Click on the “Login” button to access your account.

Understanding the Uni Credit Dashboard

Upon logging in, you will be directed to the Uni Credit dashboard. This is where you can view your account balance, transaction history, and other important financial information. Here’s a breakdown of the key features of the dashboard:

- Account Balance: Provides a real-time overview of your current account balance.

- Transaction History: Displays a detailed list of all transactions made on your account, including deposits, withdrawals, and transfers.

- Account Settings: Allows you to manage your account preferences, such as changing your password, updating your contact information, and setting up alerts.

- Financial Tools: Offers a range of tools to help you manage your finances, such as budgeting, expense tracking, and savings goals.

Managing Your Transactions

Uni Credit Login provides a variety of options for managing your transactions:

- Transfers: Allows you to transfer funds between your Uni Credit accounts or to other accounts held at different financial institutions.

- Bill Payments: Enables you to pay your bills directly from your Uni Credit account, ensuring timely payments and avoiding late fees.

- Debit Card Management: Allows you to view your debit card transactions, set spending limits, and report lost or stolen cards.

Security and Privacy

Uni Credit takes the security and privacy of its users very seriously. Here are some of the measures in place to protect your account:

- Two-Factor Authentication: Requires a second form of verification, such as a text message or an authentication app, to access your account.

- Secure Sockets Layer (SSL) Encryption: Ensures that all data transmitted between your device and the Uni Credit website is encrypted and secure.

- Regular Security Audits: Conducted to identify and address any potential vulnerabilities in the system.

Customer Support

Uni Credit offers a range of customer support options to assist you with any issues or questions you may have:

- Online Chat: Available 24/7 to provide immediate assistance with your account-related inquiries.

- Phone Support: Offers toll-free numbers for customers in different regions, ensuring easy access to support.

- Email Support: Allows you to submit your questions and receive a response via email.