Uni Swap: A Comprehensive Guide to Decentralized Exchanges

Are you curious about the world of decentralized finance (DeFi) and looking to explore the exciting possibilities of decentralized exchanges (DEXs)? One of the most popular DEXs in the market is Uni Swap. In this detailed guide, we’ll delve into what Uni Swap is, how it works, and its unique features that set it apart from other DEXs.

What is Uni Swap?

Uni Swap is a decentralized exchange built on the Ethereum blockchain. It allows users to trade various cryptocurrencies without the need for a centralized authority. The platform is based on the Uniswap protocol, which is a liquidity-based automated market maker (AMM) system. This means that instead of relying on traditional order books, Uni Swap uses liquidity pools to facilitate trades.

How Does Uni Swap Work?

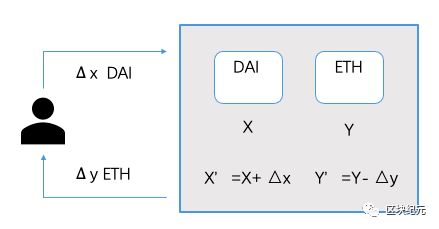

Uni Swap operates through a network of liquidity pools, which are collections of tokens locked in smart contracts. These pools are used to facilitate trades between different cryptocurrencies. When you want to trade one token for another on Uni Swap, you are essentially swapping your tokens with the tokens held in the liquidity pool for the desired cryptocurrency.

Here’s a simplified breakdown of the process:

-

Identify the tokens you want to trade and the liquidity pool associated with them.

-

Connect your wallet to Uni Swap and deposit the tokens you want to trade into the liquidity pool.

-

When someone wants to trade the tokens in the pool for your deposited tokens, you receive a share of the pool proportional to your deposit.

-

When you want to withdraw your tokens, you can do so by burning your pool share, which will remove your tokens from the pool.

Unique Features of Uni Swap

Uni Swap offers several unique features that make it a popular choice among DeFi users:

1. Low Fees

Uni Swap charges a small fee for each trade, which is used to incentivize liquidity providers. This fee is significantly lower than what you would pay on traditional centralized exchanges, making it an attractive option for cost-conscious traders.

2. High Liquidity

Uni Swap boasts some of the highest liquidity in the DeFi space, thanks to its large network of liquidity pools. This means that you can trade large amounts of tokens without worrying about slippage or liquidity issues.

3. Flexibility

Uni Swap supports a wide range of cryptocurrencies, making it easy to trade your favorite tokens. The platform also allows you to create your own liquidity pools, giving you the flexibility to trade any pair of tokens you want.

4. Community-Driven

Uni Swap is a community-driven project, which means that its development and governance are influenced by its users. This has led to a platform that is constantly evolving and improving based on user feedback.

How to Use Uni Swap

Using Uni Swap is relatively straightforward, but there are a few steps you need to follow:

-

Set up a wallet that supports Ethereum, such as MetaMask or MyEtherWallet.

-

Connect your wallet to Uni Swap by visiting the platform’s website and clicking the “Connect Wallet” button.

-

Select the tokens you want to trade and the liquidity pool associated with them.

-

Deposit the tokens you want to trade into the liquidity pool.

-

When someone wants to trade the tokens in the pool for your deposited tokens, you receive a share of the pool proportional to your deposit.

-

When you want to withdraw your tokens, you can do so by burning your pool share, which will remove your tokens from the pool.

Conclusion

Uni Swap is a powerful and versatile decentralized exchange that offers a range of benefits for DeFi users. With its low fees, high liquidity, and community-driven approach, it’s no wonder that it has become one of the most popular DEXs in the market. Whether you’re a seasoned DeFi trader or just starting out, Uni Swap is definitely worth exploring.

| Feature | Description |

|---|---|